Tipps und Tricks für die Auswahl des perfekten Wimpern-Conditioners

Entdecken Sie, wie Sie Ihren Wimpern mit dem passenden Wimpern-Conditioner einen verführerischen…

Wie funktioniert das BVG in der Schweiz?

Das schweizerische Berufsvorsorgegesetz ist ein wichtiger Grundpfeiler des Systems des Ruhestands eines…

Nicolaas Stobbe

Ich bin Nicolaas Stobbe, Gründer von Hokaido.ch, einer Plattform für Banken und Finanzen. Meine Leidenschaft für Zahlen und Wirtschaft führte mich dazu, dieses Portal zu entwickeln, das sich auf persönliche und unternehmerische Finanzen konzentriert.

Arbeit

Wie viel verdient ein Psychologe? Gehalt eines Psychologen in Polen

Psychologie ist eines der beliebtesten Studienfächer und auch einer der begehrtesten Berufe. Viele Studenten möchten wissen, wie viel ein Psychologe verdient und wie hoch sein Gehalt in Polen ist. In diesem Artikel gehen wir näher auf dieses Thema ein und stellen einige interessante Daten zum Verdienst von Psychologen in unserem Land vor.Wie viel verdient ein…

Wie viel verdient ein Rechtsanwalt? Medianeinkommen in Polen

Wissen Sie, wie viel ein Rechtsanwalt verdient? Haben Sie eine Vorstellung davon, wie hoch der Durchschnittsverdienst in Polen ist? Wenn Sie sich für das Thema «Geld verdienen im Anwaltsberuf» interessieren, ist dieser Artikel genau das Richtige für Sie. Wir sagen Ihnen alles, was Sie über den Verdienst von Anwälten in Polen wissen müssen. Der Artikel…

Wie viel verdient ein Polizeibeamter? Verdienst eines Polizeibeamten in Polen

Wie viel verdient ein Polizeibeamter? Diese Frage stellen sich viele Menschen, die sich für den Beruf des Polizeibeamten interessieren oder einfach nur neugierig sind, wie viel eine Person, die im uniformierten Dienst arbeitet, verdienen kann. Im heutigen Artikel werden wir versuchen, die Frage zu beantworten, wie hoch die Gehälter von Polizeibeamten in Polen sind. Wir…

Wie viel verdient eine Stewardess? Welche Aufgaben hat sie? Wie wird man eine Stewardess oder ein Steward?

Träumen Sie davon, Stewardess zu werden? Willst du wissen, welche Aufgaben eine Stewardess hat und wie viel eine Stewardess verdient? In unserem heutigen Artikel werden wir versuchen, diese Fragen zu beantworten. Dabei gehen wir sowohl auf berufliche als auch auf finanzielle Aspekte ein.Artikel in Zusammenarbeit mit goodatservice.comWie viel verdient eine Stewardess? Wovon hängt der Verdienst…

Wie viel verdient man als Programmierer in Polen? Verdienst in der IT-Branche

Programmieren ist einer der am schnellsten wachsenden Berufe der Welt. Programmierer sind ein wichtiges Bindeglied in kreativen und technologischen Unternehmen, deren Zahl ständig wächst. Daher ist es sehr wichtig zu wissen, wie hoch die aktuellen Gehälter von Programmierern in Polen sind. In diesem Artikel werden wir versuchen, die Frage zu beantworten, wie viel ein Programmierer…

Wie viel verdient eine Krankenschwester in Polen und wie viel in Deutschland?

Wie viel verdient eine Krankenschwester? Diese Frage beschäftigt viele Menschen, vor allem diejenigen, die einen Berufswechsel planen oder eine Auswanderung ins Ausland in Betracht ziehen. Sind die Gehälter einer Krankenschwester im Ausland höher als in Polen? In diesem Artikel werden wir versuchen, dieses Thema zu klären, indem wir die Verdienste von Krankenschwestern in Polen und…

Bankwesen und Finanzen

Wie funktioniert das BVG in der Schweiz?

Das schweizerische Berufsvorsorgegesetz ist ein wichtiger Grundpfeiler des Systems des Ruhestands eines jeden Arbeitnehmers in der Schweiz. Dabei beschäftigt sich das Gesetz mit unterschiedlichen Aspekten und soll dafür sorgen, dass niemand in die Altersarmut rutscht, sodass finanzielle Sorgen im Alter kein Thema werden. Dabei sollte man das Thema näher beleuchten, um verstehen zu können, wie…

Was ist eine Kreditzusage und garantiert sie den Erhalt einer Finanzierung?

Wer (nicht nur) ein Wohnungsbaudarlehen beantragt, stößt möglicherweise auf einen Begriff wie Kreditzusage oder, austauschbar, Bankzusage. Dieses Dokument wird von Finanzinstituten auf Antrag des Kunden ausgestellt, und viele Menschen glauben, dass der Erhalt dieses Dokuments die Gewährung eines Kredits garantiert. Leider ist dies nicht der Fall, wie im heutigen Beitrag erläutert wird. Hypothekarkredit. Ein zeitaufwändiger…

Proximity ATM – was genau ist das?

Geldautomaten sind eines der nützlichsten Instrumente in der heutigen Welt. Sie ermöglichen es Ihnen, schnell und einfach Geld von Ihrem Bankkonto abzuheben. Kontaktlose Geldautomaten sind die nächste Generation von Geldautomaten, mit denen man noch schneller und einfacher Geld abheben kann. Proximity-Geldautomaten arbeiten mit der RFID-Technologie. RFID steht für Radiofrequenz-Identifikation. Es handelt sich um eine Technologie,…

Ein Sparkonto – was ist das? Wie eröffne ich ein Sparkonto?

EinSparkonto ist eine hervorragende Möglichkeit, Ihr Geld zu vermehren. Sie können regelmäßig sparen oder größere Beträge auf das Konto legen. Finden Sie heraus, was genau ein Sparkonto ist, worum es geht, wann und warum es sich lohnt, eines zu eröffnen!Was genau ist ein Sparkonto? Definition des BegriffsEin Sparkonto ist eine besondere Art von Bankkonto, auf…

Retail Banking – was ist das und was beinhaltet es?

DasPrivatkundengeschäft ist ein weit gefasster Finanzdienstleistungssektor, der die gesamte Palette an Finanzprodukten und -dienstleistungen umfasst, die von Banken für Privatpersonen und kleine Unternehmen angeboten werden. Das moderne Retail-Banking nutzt modernste Technologien wie Online-Systeme, Kreditkarten, Online-Überweisungen und mehr, um seinen Kunden ein Höchstmaß an Service und Sicherheit zu bieten.Was ist Retail-Banking? Definition des BegriffsDer Begriff «Retailbanking»…

Ethisches Bankwesen – was ist das und was beinhaltet es?

Ethical Banking ist ein innovatives Geschäftsmodell, das den Erwartungen der heutigen Verbraucher voraus ist. Die Idee hinter dem Konzept ist es, den höchstmöglichen Standard an Finanzdienstleistungen auf verantwortungsvolle und ethische Weise anzubieten. Dies ermöglicht es, die Bedürfnisse der Kunden zu erfüllen und gleichzeitig ihre Privatsphäre zu respektieren sowie die lokalen und globalen rechtlichen Anforderungen einzuhalten.Was…

Beruf

Schweißer – wie sieht ein Arbeitstag aus? Wie sieht der Karriereweg und das Gehalt aus?

Schweißer ist einer der gefragtesten Berufe in der Metallindustrie. Der Beruf erfordert Präzision, Erfahrung, Wissen und Können. In diesem Artikel werden wir erörtern , wie es ist, als Schweißer zu arbeiten, welche Kurse und Studien man absolvieren muss, um in diesem Beruf zu arbeiten, wie ein typischer Arbeitstag aussieht, wie die Karriere aussieht und…

Zahnärztin – Gehälter in Wrocław – wir prüfen!

Wrocław, eine Stadt, die für ihren boomenden medizinischen Sektor bekannt ist, entwickelt sich zu einem Ort, an dem der Beruf des Zahnarztes eine neue Dimension annimmt – sowohl im Hinblick auf die beruflichen als auch auf die finanziellen Möglichkeiten. In diesem Artikel werfen wir einen Blick darauf, wie viel Zahnärzte in der Hauptstadt von Niederschlesien…

Was ist die Aufgabe eines Personalleiters? Verantwortlichkeiten, Fähigkeiten und Schritte, um einer zu werden

Hier ist er! Das Multitalent der HR-Seite der Macht – der HR-Manager! Finden Sie heraus, wer er ist, was er kann und wie Sie einer werden können. Hier ist er! Der vielseitige Allrounder der HR-Seite der Macht – der HR-Manager! Finden Sie heraus, wer er ist, was er kann und wie Sie einer werden können….

Bühnenbildner – wie sieht ein Arbeitstag aus? Wie sieht der Karriereweg und das Gehalt aus?

Sind Sie neugierig auf den Beruf des Bühnenbildners? Wissen Sie, welche Studien und Kurse Sie absolvieren müssen, um in diesem Beruf arbeiten zu können? Oder interessieren Sie sich dafür, wie der Berufsweg aussieht und wie hoch die Gehälter von Bühnenbildnern sind? In diesem Artikel erfährst du alles, was du über den Arbeitsalltag eines Bühnenbildners, die…

Banker – wer ist das? Definition des Begriffs

Ein Banker ist eine Person, die für die Entgegennahme, Verarbeitung und Speicherung von Finanzinformationen zuständig ist. Ein Banker ist eine Person, die Kunden bei der Verwaltung ihrer Finanzen und der Auswahl der richtigen Produkte hilft. Er oder sie ist eine Person, die Finanzdaten verarbeiten und speichern kann und angibt, was das Beste für den Kunden…

Handwerker – wie sieht der Arbeitsalltag aus? Wie ist der Karriereweg und das Gehalt?

Wer als Handwerker arbeiten möchte, sollte wissen, wie ein typischer Arbeitstag aussieht, welche Studien und Kurse man absolvieren muss, um die erforderlichen Qualifikationen zu erwerben, wie hoch das Gehalt ist und wie die berufliche Laufbahn in diesem Beruf aussieht. In diesem Artikel werden all diese Aspekte behandelt, damit Sie verstehen, wie der Beruf des Handwerkers…

Für Arbeitgeber

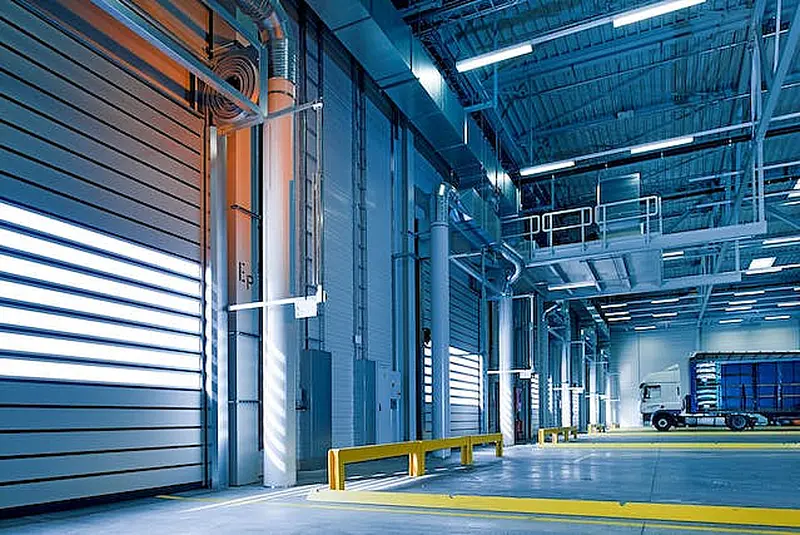

Effiziente Lagerorganisation: Die Vorteile von Lagerbühnen in der Praxis

Eine effiziente Lagerorganisation ist entscheidend für den Erfolg jedes Unternehmens, das Waren lagert und bearbeitet. Ein gut organisiertes Lager ermöglicht eine schnelle und präzise Auftragsabwicklung, reduziert Fehler und steigert die Gesamtproduktivität. Eine der größten Herausforderungen bei der Lagerorganisation ist die optimale Nutzung des vorhandenen Raumes. Hier spielen Lagerbühnen, wie Zwischenböden und Mezzanine, eine Rolle. Diese…

Wie wird man Chef vor 30? Erfahren Sie praktische Tipps

Wie wird man Chef vor 30? Eine unrealistische Vision oder eine Chance zum Greifen nah? Immerhin wurde Mark Zuckerberg, der Erfinder des sozialen Netzwerks Facebook, im Jahr 2008 zum jüngsten Milliardär – damals war er gerade einmal 23 Jahre alt. Jack Dorsey begann seine Karriere als Start-up und baute später das Netzwerk Twiiter auf. Heute…

Beschäftigung von Ausländern in Polen Arbeitsrecht

Beschäftigung von Ausländern in Polen – das sollte jeder Arbeitgeber wissen, der Ausländer in seinem Unternehmen beschäftigt. InhaltsübersichtRechtliche GrundlagenGrundlegende DefinitionenGrundsätze der Arbeitsleistung von Ausländern in der Republik PolenGrundlagen für die Erteilung von Arbeitsgenehmigungen für AusländerBedingungen für die Erteilung von ArbeitsgenehmigungenVereinfachtes Verfahren (sog. Meldeverfahren)Dauer der ArbeitserlaubnisBefreiung von der Pflicht zur Einholung einer ArbeitserlaubnisVisumPflichten der Arbeitgeber gegenüber…

Das Steuerverwaltungssystem in Polen. Was müssen Sie darüber wissen?

Das Steuerverwaltungssystem in Polen fällt in die Zuständigkeit von zwei Arten von Behörden:die Regierung (CIT, PIT, Mehrwertsteuer, Verbrauchssteuer, Steuer auf zivilrechtliche Transaktionen)die lokalen Gebietskörperschaften (Grundsteuer, Steuer auf Verkehrsmittel).Die Steuerverwaltung ist zweistufig, d.h. gegen die Entscheidungen der ersten Instanz kann bei der zweiten Instanz Berufung eingelegt werden.Zu den Steuerbehörden gehören:DerLeiter der nationalen Steuerverwaltung, der unter anderem…

Verwaltung der Humanressourcen: 3 Hauptpunkte

DieVerwaltung der Humanressourcen ist eine der Säulen der Unternehmensentwicklung. Wenn Sie nicht wissen, wie Sie Ihre Aktivitäten, Beziehungen, Menschen und Situationen managen können, existieren Sie nicht. Obwohl sich natürlich jeder in gewissem Maße selbst steuert.Grundlegende Punkte des ManagementsJede Führungskraft muss sich bei ihrer Managementtätigkeit unbedingt von folgenden Punkten leiten lassen:die allgemeine politische Lage;die wirtschaftliche Lage;die…

Wie führt man intelligente Mitarbeiter? Ratschläge für den Chef

Wie kann man intelligente Mitarbeiter führen? Das ist nach wie vor eine Herausforderung, schließlich beschweren sich Chefs am häufigsten über ihre Untergebenen. Sie sagen, sie seien inkompetent, ohne Initiative, träge, diebisch, gierig usw. Aber das ist nicht immer der Fall – Stereotypen sind dazu da, um gebrochen zu werden.Der Mitarbeiter ist der Wert des UnternehmensKürzlich…

Für Bewerber

Beendigung eines Arbeitsvertrags – durch Arbeitnehmer, Arbeitgeber und durch Vereinbarung!

Die Entscheidung, ein Arbeitsverhältnis zu beenden, kann schwierig sein, aber es ist wichtig zu wissen, wie man einen Arbeitsvertrag richtig kündigt. Kennen Sie die Unterschiede zwischen einer Kündigung durch den Arbeitnehmer und durch den Arbeitgeber? Oder fragen Sie sich, wie eine Kündigung im gegenseitigen Einvernehmen aussieht? In diesem Artikel beantworten wir diese und weitere Fragen.Beendigung…

Wie bekommen Sie eine Stelle? Beweisen Sie, dass Sie die richtige Person für das Unternehmen sind

Wie bekommen Sie den Job, den Sie wollen? Sie sind schon eine Weile auf der Suche nach einer neuen Stelle, Sie sind zu Vorstellungsgesprächen gegangen, aber Sie haben immer noch nicht den begehrten Anruf erhalten, in dem es heißt: Sie haben die Zusage erhalten! Haben Sie Pech, gibt es bessere Bewerber oder liegt das Problem…

Wen sollten Sie nicht einstellen? 6 Persönlichkeitstypen

Wen sollten Sie in Ihrem Unternehmen nicht einstellen? Stellen Sie sich folgende Situation vor: Sie sind ein großer Chef, ein Bewerber für eine gute Stelle sitzt Ihnen am Verhandlungstisch gegenüber und Sie wollen ihm eine gut bezahlte Stelle als Ihr Untergebener anbieten. Er sieht gut aus, redet noch besser, sein Lebenslauf ist mit den Namen…

Wie sprechen Sie mit Personalvermittlern und Arbeitgebern? Wir geben Ihnen einen Tipp!

Wie spricht man mit einem Personalverantwortlichen, um bei einem Vorstellungsgespräch erfolgreich zu sein? Wenn sich ein Bewerber um eine Stelle bewirbt, wird er häufig zunächst von einer Personalagentur und dann direkt mit dem Unternehmen befragt. Der Personalvermittler ist eine externe Organisation und kann daher nicht immer vollständige Informationen über das Unternehmen liefern.Wie spricht man mit…

Was soll in Ihrem Lebenslauf stehen? Finden Sie heraus, welche Informationen Sie nicht weglassen sollten!

Was sollten Sie in Ihrem Lebenslauf schreiben, damit ein Arbeitgeber Sie zu einem Vorstellungsgespräch einlädt? Ein guter Lebenslauf ist die halbe Miete. Es lohnt sich also, darauf zu achten, was und wie Sie in dem Dokument schreiben.Was sollte ich in meinen Lebenslauf schreiben? Wichtige InformationenDie folgenden Informationen können Ihnen helfen zu verstehen, warum Ihr Lebenslauf…

Wie man aufhört, frustriert zu sein: Die 4 wichtigsten Gründe, die der Arbeit im Wege stehen

Wie hört man auf, bei der Arbeitnervös zu sein ? Gelassenheit fördert zweifellos nicht nur das psychische Wohlbefinden, sondern auch die Produktivität bei der Arbeit. Wenn Sie also Ihre Nerven beruhigen und Ihre Arbeit genießen wollen, lesen Sie den folgenden Artikel. Wie kann man aufhören, nervös zu sein? Erstens, die Ursache kennenDenersten Platz in der…

Ratgeber

Tipps und Tricks für die Auswahl des perfekten Wimpern-Conditioners

Entdecken Sie, wie Sie Ihren Wimpern mit dem passenden Wimpern-Conditioner einen verführerischen Look verleihen können. Erfahren Sie mehr über die Auswahl, Anwendung und Vorteile in unserem Leitfaden. Wimpern-Conditioner kann ein wahrer Wachstumsbooster für Ihre Wimpern sein und ihnen dabei helfen, länger, dicker und gesünder auszusehen. Aber wie weiß man, welcher Conditioner der richtige ist? Dieser…

Was ist der Rückkauf auf Schadensersatz?

Hatten Sie schon einmal mit einer Situation zu kämpfen, in der der Versicherer die Höhe der Ihnen zustehenden Entschädigung unterschätzt hat? Der Rückkauf von Haftpflichtansprüchen kann die Antwort auf Ihre Probleme sein. Es handelt sich um eine Lösung, die es Ihnen ermöglicht, schnell und effektiv Gelder zurückzuerhalten, ohne sich auf langwierige und oft komplizierte Verfahren…

Was sind die häufigsten Symptome und Ursachen der Parkinson-Krankheit?

Diese neurodegenerative Erkrankung, die weltweit intensiv erforscht wird, stellt eine Herausforderung für Neurologie. In diesem Kontext ist das Verständnis der Symptome und Ursachen essenziell für eine effektive Diagnose und Therapie der Parkinson-Krankheit. Symptome der Parkinson-Krankheit: Welche sind am häufigsten zu beobachten? Dazu gehören insbesondere motorische Störungen wie Zittern (Tremor), Steifigkeit (Rigor) und verlangsamte Bewegungen (Bradykinese)….

Derevbud: Ihr Partner beim Bau Ihres Traumhauses aus Holz

In einer Zeit, in der das Interesse an umweltfreundlichem und nachhaltigem Bauen wächst, entwickelt sich Derevbud zu einem der führenden Anbieter von Blockhäusern. Das renommierte Bauunternehmen verbindet seine Leidenschaft für traditionelle Handwerksmethoden mit den neuesten Trends in der Architektur, um nicht einfach nur Häuser zu bauen, sondern wahre Kunstwerke, die sowohl schön als auch funktional…

Kühlregale – ein Muss für Ihren Lebensmitteleinkauf!

Wenn Sie einen Lebensmittelladen, eine Konditorei oder einen anderen Ort betreiben, an dem Sie Lebensmittel oder Getränke bei niedrigeren Temperaturen aufbewahren müssen, ist es wichtig, die richtigen Kühlmöbel zu kaufen! Sie dienen nicht nur der Präsentation der angebotenen Produkte, sondern halten sie auch frisch. Was sind Kühlvitrinen und welche Vorteile bieten sie?Einige Lebensmittel und Getränke…

Metallzäune: Der Schlüssel zu einem professionellen Firmenimage

Entdecken Sie, wie solide Metallzäune das Image Ihres Unternehmens verbessern und ein sicheres und ästhetisch ansprechendes Umfeld schaffen können, das Kunden und Mitarbeiter beeindruckt.Zäune aus Polen: Wie Metallzäune das Firmenimage aufwertenZäune aus Polen sind nicht nur eine praktische Lösung, sondern auch ein Schlüsselelement, das die Wahrnehmung eines Unternehmens erheblich beeinflussen kann. In der heutigen Zeit,…

Beliebt

Hokkaido: Landschaft, Sehenswürdigkeiten, Karriere

Heute stellen wir Ihnen Hokkaidō vor, die zweitgrößte Insel Japans. Mit ihrer spektakulären Landschaft, die von schneebedeckten Bergen bis zu unberührten Küsten reicht, bietet Hokkaido Besuchern aus aller Welt eine Vielzahl von Sehenswürdigkeiten und Erlebnissen. Doch neben seiner natürlichen Schönheit ist Hokkaido auch als aufstrebendes Zentrum für Karrieremöglichkeiten in verschiedenen Branchen bekannt. Tauchen Sie mit…

Herbstliche Inspiration: Der Hokkaido-Kürbis als Star der Saison

Der aus Japan stammende Hokkaido-Kürbis (bekannt auch als Uchiki Kuri) gehört zu den beliebtesten Gemüsesorten im Herbst und zu den kleinsten Gartenkürbissen. Lebendig wirkend und äußerst vielseitig ist dieser Kürbis nicht nur eine Augenweide, sondern auch eine wahre Gaumenfreude. Entdecken Sie mit uns die Geheimnisse und Vorteile dieses herbstlichen Schatzes. Hokkaido Kürbis im Überblick Sind…